Meet Seasonal Demands with Payroll Funding for Hospitality Staffing

By: Craig Cohen, Director of Sales

Craig is an experienced risk manager with the entrepreneurial spirit and leadership skills that support Encore client success.

By: Kim (Castagnola) Joyce, Director of Client Services

Kim ensures all Encore clients receive the best service possible. She leads new client onboarding and manages ongoing client experiences.

The Hospitality Industry Thrives On Flexibility

Whether it’s peak tourist season, holidays, or large events, we’ve seen how hospitality staffing entrepreneurs scale their workforce quickly to meet fluctuating demand. However, cash flow gaps caused by delayed client payments can make it difficult to cover payroll on time. That’s where payroll funding for hospitality staffing becomes a game-changer.

At Encore, we support hospitality staffing agencies of all sizes to meet demands during busy season. Read on as we explore the challenges of seasonal workforce fluctuations, compare funding options, and highlight how payroll funding for hospitality staffing empowers you to grow and remain competitive. Plus, hear about the real achievements of one hospitality staffing client based in Miami!

Seasonal Workforce Challenges in Hospitality Staffing

You’re up against unique financial pressures because of rapid shifts in demand. Unlike industries with stable workforce needs, hospitality businesses experience extreme employment swings based on seasonal trends, holidays, and special events. Based on your location and niche, you might feel just one of these waves or most of them!

Peak Seasons for Hospitality Staffing Agencies

- Summer Tourist Season – Increased demand for hotel, restaurant, and event staff in resort and vacation hotspots.

- Winter Holidays – High demand for catering, banquet services, and holiday event staffing.

- Spring Break & Festivals – March-April spikes in vacation destinations, music festivals, and large events.

- Conference & Convention Seasons – Cities hosting major events require temporary workers for hotels and venues.

- Sporting Events – Large-scale tournaments, marathons, and championship games drive hospitality staffing needs.

At times, it probably feels like you can’t catch a break between these peaks! We’ve talked to plenty of hospitality staffing entrepreneurs who confess they’re overwhelmed. They also tell us that these are the most common challenges they face month after month. Do any of them sound familiar?

- Payroll Strains – A sudden influx of workers increases payroll demands, which can create liquidity issues if funds aren’t readily available.

- Overhead Costs – Recruiting, onboarding, and training seasonal workers require upfront investment, even before revenue comes in the door.

- Unpredictable Demand – Forecasting revenue and expenses accurately is difficult due to fluctuating client needs.

- Credit Constraints – Traditional bank loans often involve long approval processes (90-120+ days) and strict requirements, making them impractical for urgent payroll needs.

- Cash Flow Gaps – Agencies must pay workers weekly or biweekly, while clients (hotels, restaurants, and event venues) often operate on net-30 to net-90 payment terms.

Hospitality staffing entrepreneurs are also up against high staff turnover. This can make it challenging to retain a qualified candidate pool.

Let’s pause. So far, we’ve covered what feels like a stressful situation. Perhaps this is what you face month after month, but there is a better path! Most of these challenges can be resolved with payroll funding for hospitality staffing. Let’s explore how it can help you level-up your growth while smoothing operations.

Funding Options for Seasonal Fluctuations

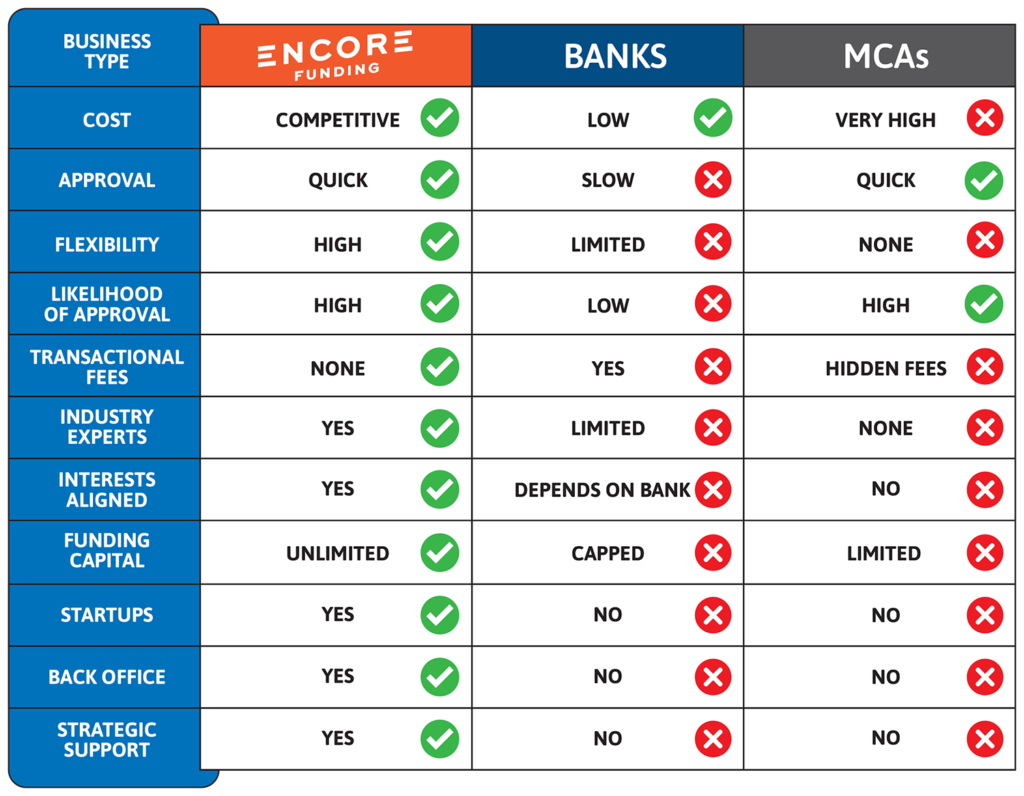

To manage payroll during peak seasons, you may have already looked for financing. Here’s how different financing solutions compare.

Why Payroll Funding is the Best Choice

Unlike loans or MCAs, payroll funding for hospitality staffing provides immediate working capital to cover payroll costs when you need it most. You submit your outstanding invoices and we pay you up to 90% of the invoice total. Then, when your client pays the invoice, we pay you the balance, minus a small fee. This allows you to scale your workforce without taking on unnecessary debt.

With access to reliable payroll funding, we’ve helped staffing entrepreneurs:

- Fill large contracts quickly for major event staffing deals without financial hesitation.

- Offer competitive pay to attract and retain top-tier hospitality staff.

- Win new clients to outpace competitors in the market.

- Reduce financial stress with payroll-related cash flow worries.

Read on to see how our team helped one Miami-based staffing firm come out on top after a series of ups and downs.

Build a Strategic Partnership with a Payroll Funding Provider

This client serviced major hotels, resorts, and event venues in beautiful Miami, Florida. Their struggles before payroll funding made operations overcast, even in the Sunshine State.

Before this client approached Encore Funding, they:

- Struggled with cash flow gaps due to 45-60 day payment delays from hotels and event venues.

- Turned down large seasonal contracts consistently due to payroll constraints.

- Spent too much time chasing invoices instead of growing the business.

Our team jumped in to support their growth and put these challenges in the past.

They are happy to report that after they started working with Encore Funding, they

- Grew their client base by 40% in one year by securing larger event contracts!

- Eliminated cash flow gaps – employees were paid on time, every time.

- Improved service quality, leading to increased client retention.

If you deal with high seasonal demand, you recognize these points as a major win! Clients in similar situations have told us that when they know payroll is covered, they feel empowered to pursue larger contracts.

Why Work With a Specialized Payroll Funding Provider?

Payroll funding for hospitality staffing can be a game-changer, but not all payroll funding providers are the same. Partnering with an experienced payroll funding provider ensures:

- Scalability – Funding adapts to your seasonal needs.

- Optional full-service solutions – Payroll processing, invoicing, and collections support.

- Industry expertise – We understand the hospitality staffing landscape and offer customized solutions.

Meet Seasonal Demands with Payroll Funding for Hospitality Staffing

In the fast-paced hospitality industry, cash flow challenges might hold you back. Payroll funding for hospitality staffing provides you with the financial flexibility to scale confidently, take on bigger contracts, and focus on growth. (And we like to hear that you sleep better at night.)

At Encore Funding, we specialize in bridging staffing cash flow gaps so you can thrive during peak seasons. Are you ready to take your agency to the next level? Let’s talk! Apply here and an Encore team member will contact you.

216-998-9900

216-998-9900