Invoice Factoring Fees: How Much Does It Cost?

Invoice factoring is a financial tool that provides staffing businesses like yours with flexible financing options. Invoice factoring fees vary, as Tim Sardinia, our Executive Vice President, explains in his video below. Watch or read on to uncover how much invoice factoring costs and the extra benefits it offers compared to traditional financing.

How Much Does Invoice Factoring Cost?

The short answer is: it depends! There are typically two kinds of invoice factoring fees, a discount fee and service fee.

Discount fees are the main cost associated with invoice factoring. They’re calculated as a percentage of the total value of your invoices, usually 1-3%. The discount fee is typically determined by a variety of factors such as the number and size of your invoices, the time it takes for customers to pay you and the creditworthiness of your customers.

Service fees are typically less than the discount fee. Service fees cover administrative costs associated with setting up and tracking invoices, monitoring customer payments, invoice collection and other services.

On top of discount and service fees, it’s common for factors to charge you an up-front fee for invoice factoring services, but not Encore Funding. We keep it simple and cost effective for you to factor invoices and keep cash flowing through your staffing business.

Because factors focus their credit decisions almost solely on a client’s accounts receivables, you understand your rates and receive funds much quicker than you would with traditional bank financing.

What Influences Invoice Factoring Fees?

There are a number of considerations that factors like Encore Funding make to determine your invoice factoring fees.

- Strength of your customers’ credit: A major benefit of invoice factoring vs. traditional financing is that factors take your customers’ credit into account, not yours. The better your customers’ credit, the less risk they present to a factor, the lower your invoice factoring fee.

- Number of customers invoiced: Factors are interested in the number of clients you do business with. More clients on your roster spreads the risk out which can lower your factoring fees. Conversely, a larger number of clients may increase your service fees.

- Funding-only vs. Full-service factoring: In staffing, there are usually two main kinds of factoring: funding-only or full-service factoring. Full-service factoring increases your fees because there are added benefits like client credit monitoring, invoicing, payroll processing, payroll tax preparation and filing, W-2s and more. Learn more about our solutions for both services here.

- Payment terms for your customers. It’s very important to be on a consistent invoice schedule with your customers. If a factor observes that invoices are typically unpaid for a long time, it may increase your fees because the risk increases the longer invoices are outstanding.

Invoice Factoring vs. A Bank Loan

While a bank loan can offer your staffing business some much-needed cash, it usually comes with time-consuming paperwork, administrative tasks and strict requirements. With invoice factoring, you get the funds upfront without a lengthy approval process from a bank. Plus, invoice factoring is considered off-balance sheet debt so it won’t show up on your financials.

Also, factors heavily focus credit decisions on the strength of your customers rather than the strength of your balance sheet. Let’s use a relatively new staffing company as an example. Banks will most likely turn a staffing entrepreneur down for a loan because the balance sheet doesn’t meet their strict requirements. However, if the staffing company’s customers are creditworthy, they will have a tremendous amount of liquidity available to them with a factor.

Although a bank loan is usually less expensive, the benefits of partnering with a trusted funding partner like Encore Funding will support your long-term growth more. By nature, banks discourage their clients from growing quickly because of strict regulations. A factoring partner not only embraces client growth, but can also provide the additional financing needed to fuel it.

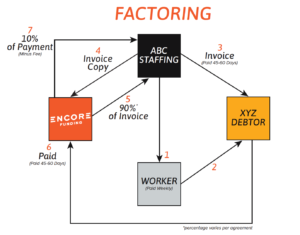

When you use payroll funding, the funder (Encore) advances up to 90% of the invoice while you wait for payment. Once your clients pay their invoice, we complete the transaction by depositing the remaining balance, minus a small fee, into your bank account.

The Application & Approval

During the factoring application process, new staffing entrepreneurs often think poor personal or business credit means they can’t access funding. Not true! As mentioned above, your customers’ credit histories are much more important to a factor.

Another myth is that an invoice factoring application is lengthy. Again, this isn’t the case. At Encore Funding, it’s a simple process that takes no longer than 10 business days from start to finish. Here are the requirements for invoice factoring application and approval at Encore Funding:

- Completed Application: One to two pages that share more information about your business so we can get to know you.

- Articles of Incorporation: This is simply to verify that your business exists!

- A current accounts receivable aging report: It’s important for us to know how long it takes for your customers to pay you.

- Customer list: We verify who you do business with to run a credit report on each customer (your customers won’t know their credit was checked).

- Proof of Workers Compensation Insurance: This is to ensure you have the right coverage for your business.

- Copies of customer contracts: It’s important for us to make sure you have a binding legal relationship with each of your customers.

Is Invoice Factoring Right for You?

As a new staffing entrepreneur, you should evaluate all financing options available to you. Factoring, bank financing, asset-based lending; each has its own benefits, but factoring is often the best option for staffing firms.

To summarize, a trusted factoring partner like Encore Funding provides easy access to working capital without the hassle of complex paperwork and approval processes. Additionally, invoice factoring focuses on the strength of your customers’ creditworthiness rather than your own business balance sheet.

We are entrepreneurs serving entrepreneurs. Our passion is to help you grow! Apply here and one of our friendly team members will be in touch to discuss your customized fee structure.

216-998-9900

216-998-9900