How Payroll Funding Promotes Industry Diversity, Supports Minority-Owned Staffing Agencies

By: Craig Cohen, Director of Sales

Craig is an experienced risk manager with the entrepreneurial spirit and leadership skills that support Encore client success.

How Payroll Funding Supports Minority-Owned Staffing Agencies

Access to cash remains a persistent challenge for minority-owned staffing agencies. The 2022 Fed Small Business Credit Survey found that only 19% of Hispanic-owned, 16% of Black-owned, and 15% of Asian-owned firms received all the financing they applied for, compared to 35% of White-owned firms. This disparity persists even among businesses with strong credit scores.

Unequal access to traditional financing restricts growth and undermines industry diversity. Our team at Encore Funding is committed to accessible capital for underrepresented staffing agency owners. See how equal access to cash can support your business growth.

1. Maintain Consistent Cash Flow

Delayed client payments can create a precarious financial situation, especially for smaller agencies. Payroll funding provides a steady cash flow, which can help your business meet payroll deadlines and maintain smooth operations.

2. Enable Growth Opportunities

With financial flexibility, minority-owned agencies can confidently compete with larger firms, take on larger contracts and expand into untapped markets.

3. Build Credibility and Winning Contracts

Employees and clients value dependability. On-time payroll can foster trust among your staff and strengthen your agency’s reputation. This reliability can unlock new opportunities for minority-owned staffing agencies.

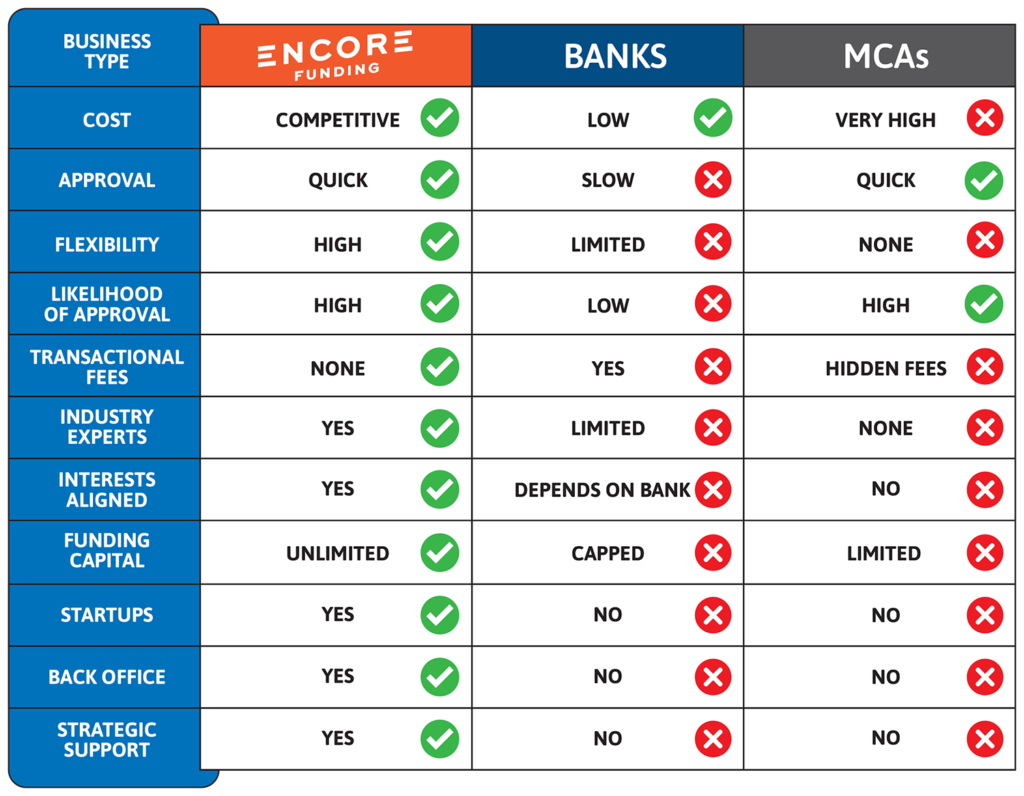

Bonus: Gain More with Payroll Funding vs. Traditional Financing

See what it’s like to be an Encore Funding client!

Foster Industry Diversity Through Financial Support

Equitable access to cash creates a more inclusive staffing industry for minority-owned staffing agencies. Our funding solutions have helped many staffing agencies owned by entrepreneurs from underrepresented groups.

How to Maximize Growth Opportunities

You may be familiar with these options to help supercharge your growth potential.

- Get Certified: Obtain certifications like MBE (Minority Business Enterprise) and WBE (Women Business Enterprise) to enhance credibility and open doors to new clients and contracts.

- Utilize Industry Resources: Tap into organizations and networks designed to support minority business growth. For applicable clients, I often direct them to these resources:

- Minority Business Development Agency (MBDA): This federal agency offers business centers, grants, and loans designed to support minority businesses.

- Small Business Development Center (SBDC): Provides free, practical business empowerment through one-on-one consulting and online resources.

- Partner with Aligned Financial Organizations: Collaborate with financial partners, like Encore Funding, that understand the importance of better access to cash and provide tailored solutions.

Unlock Potential Through Better Funding

Access to more cash through payroll funding can be a game-changer for minority-owned staffing agencies. It can help you scale operations, maintain credibility, and compete effectively.

Encore Funding is dedicated to providing equitable financial solutions that foster growth and inclusion in the staffing industry. Ready to secure your agency’s financial future? Let Encore Funding help you grow with confidence. Apply for funding here.

216-998-9900

216-998-9900