7 Myths About Payroll Funding

The Truth Behind 7 Payroll Funding Myths

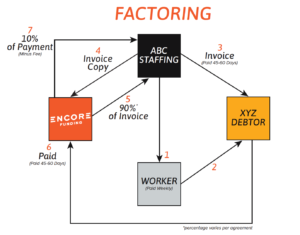

As a growing staffing entrepreneur, you’ve probably heard about payroll funding. Also known as invoice factoring, you sell your invoices for cash in advance so you don’t have to wait 30 (or even 90) days to get paid. This is often where the truth about payroll funding stops and the myths begin.

Read on to bust some of the biggest misconceptions about payroll funding and learn how you can take advantage of it to grow your business.

Myth 1: Payroll Funding is Expensive

Staffing entrepreneurs often assume that payroll funding is expensive; however, this isn’t the case, especially with Encore Funding. Fees can vary depending on your clients’ payment history, the size of your business, and the type of services you need. Our industry experts break down invoice factoring or payroll factoring rates here.

Before you make a decision, compare the fee structures from multiple funders to ensure a competitive rate. There are comparison tools available online to find the best deal; however, you’ll find the most accurate rates by contacting a payroll funder, like Encore Funding, directly.

At Encore Funding, we make the experience personal. If you’d like a custom quote for funding, reach out to our team or start your application online!

Myth 2: It’s Overly Complicated

Though it may feel intimidating at first, payroll funding doesn’t need to be complicated. The process of getting funded is surprisingly straightforward. Typically, you’ll need to provide proof of your business operations, your aging report, and client information. Tim Sardinia, Encore Funding Executive Vice President, explains what you should have on hand during the application process here.

When you partner with Encore Funding, it takes no more than ten business days to begin to receive your cash! We make the entire process simple and efficient from start to finish. Thanks to our streamlined onboarding process and helpful team members, we can get you funded in no time.

When you use payroll funding, the funder (Encore) advances up to 90% of the invoice while you wait for payment. Once your clients pay their invoice, we complete the transaction by depositing the remaining balance, minus a small fee, into your bank account.

Myth 3: Payroll Funding Is Only for Large Companies

Payroll funding is available to (and used by) staffing firms of all sizes. From startup firms in their first year to established leaders in the industry, it helps staffing firms grow at a faster rate than non-funded peers. It’s important for smaller firms just starting out look for a provider who understands your business and can offer solutions that fit your budget. At Encore Funding, we get to understand your staffing firm’s unique needs to help you grow.

When looking for payroll funding, staffing entrepreneurs should consider fees, turnaround time, customer service support and any additional services or resources you may need. Encore Funding offers competitive rates and tailored solutions for staffing firms of all sizes, from funding-only to full-service solutions that include back-office support and strategic solutions in addition to funding. We’re here to support your staffing firm as it grows and evolves.

Myth 4: It Involves Too Much Risk

A benefit of payroll funding is that your rate is largely dependent on your clients’ creditworthiness and payment history, not yours. To minimize this risk, make sure to thoroughly vet your potential clients and provide clear payment terms and conditions.

A funding partner like Encore Funding can provide the tools, resources and guidance you need to stay ahead of any potential risks in the market. Our industry experts become a part of your team.

Myth 5: Payroll Funding is Only for Short-Term Needs

While the cost for short and long-term needs can vary depending on the provider, it’s important to understand your current financial status and goals to ensure your contract terms support your growth path.

At Encore Funding, we partner with staffing firms to create long-term plans that provide financial stability and peace of mind. This helps you get the most out of payroll funding! We take the time to understand your business and offer you the smartest solution for your needs. Our decades of experience and industry knowledge back up our recommendations.

Myth 6: Bank Loans are Easier

Unlike factoring with Encore Funding, bank loans can come with hidden costs like fees for late payments, early repayment and more. Additionally, banks often place restrictions on the use of loan funds. This could include limiting how much money you can borrow or when it must be paid back. That makes it difficult to stay nimble and responsive to your clients’ needs.

Banks also have more stringent requirements that you may not meet as a new or growing staffing firm. This can also prohibit you from increasing your line of credit quickly to take on a large opportunity.

As entrepreneurs, we understand that you need the flexibility to act quickly to remain competitive. That’s why our payroll funding solutions are tailored to your individual business needs. Simply put, we’ll grow with you so that the funding is there when you need it most.

Myth 7: Payroll Funding is Difficult to Change

Staffing entrepreneurs who haven’t used payroll funding before may assume that once they sign their contract with a funder, they’re stuck with it. Other funding providers require firms to sign long-term contracts. At Encore funding, we know that as growing staffing firm, your business, your clients and your funding needs may change year to year, or sooner.

We understand that you need to stay agile and responsive. That’s why our contracts are designed with the flexibility and freedom you need to make changes when necessary. Your dedicated Account Executive is just a phone call or email away.

Our team is here to help you get the most out of payroll funding services. We provide comprehensive guidance and support so you can make informed decisions about your next business move.

Payroll Funding Myths, Busted

There’s a ton of information about payroll funding out there. it can be difficult to sort through fact versus fiction. If you have further questions or want to learn more about payroll funding, visit our FAQ page.

We’re interested in getting to know you and your business goals. Reach out to our team here with specific questions and we’ll get in touch shortly!

216-998-9900

216-998-9900